peyk.site

Overview

Closed End Bond

All closed-end funds (CEFs) were structured as perpetual funds, meaning they have no “maturity” or termination date. Closed-end funds, unlike open-end funds, are typically not continuously offered. The closing price and net asset value (NAV) of a fund's shares will fluctuate. What is a closed-end fund? A closed-end fund holds an IPO at launch and the money raised from that IPO is used by portfolio managers to buy securities. Closed End Funds · Performance · BrandywineGLOBAL - Global Income Opportunities Fund Inc. · ClearBridge Energy Midstream Opportunity Fund Inc. · ClearBridge MLP. A closed-end fund raises capital for investment through a one-time sale of a limited number of shares, which may then be traded on the markets. Like other public companies, closed-end funds have a one-time initial public offering, and once their shares are first issued, are generally bought and sold. Closed-end funds (“CEFs”) can play an important role in a diversified portfolio as they may offer investors the potential for generating capital growth and. A common misunderstanding is that a closed-end fund is a type of traditional mutual fund or an exchange-traded fund (ETF). A closed-end fund invests the money raised in its initial public offering in stocks, bonds, money market instruments and/or other securities. Here. All closed-end funds (CEFs) were structured as perpetual funds, meaning they have no “maturity” or termination date. Closed-end funds, unlike open-end funds, are typically not continuously offered. The closing price and net asset value (NAV) of a fund's shares will fluctuate. What is a closed-end fund? A closed-end fund holds an IPO at launch and the money raised from that IPO is used by portfolio managers to buy securities. Closed End Funds · Performance · BrandywineGLOBAL - Global Income Opportunities Fund Inc. · ClearBridge Energy Midstream Opportunity Fund Inc. · ClearBridge MLP. A closed-end fund raises capital for investment through a one-time sale of a limited number of shares, which may then be traded on the markets. Like other public companies, closed-end funds have a one-time initial public offering, and once their shares are first issued, are generally bought and sold. Closed-end funds (“CEFs”) can play an important role in a diversified portfolio as they may offer investors the potential for generating capital growth and. A common misunderstanding is that a closed-end fund is a type of traditional mutual fund or an exchange-traded fund (ETF). A closed-end fund invests the money raised in its initial public offering in stocks, bonds, money market instruments and/or other securities. Here.

Municipal Bond Funds In terms of assets under management, this is the largest category of closed-end funds. Municipal bond funds seek to pay out income to. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest. Get up-to-date information on Closed-End Funds from MFS. With details on pricing and performance, you can make an informed decision. BlackRock closed-end funds provide several advantages to producing more income with less risk. Learn why these investment strategies are right for you. What is a Closed-End Fund? A closed-end fund is a publicly traded investment company that invests in a variety of securities, such as stocks and bonds. What is a Closed-End Fund? A closed-end fund is a publicly traded investment company that invests in a variety of securities, such as stocks and bonds. For search purposes, please note that closed-end funds are registered with Bond Fund, EIM and Municipal Bond Cl FS, EIM and EV Funds Governance Committee. Closed-End Fund Types and Strategies. Closed-end funds offer regular distributions based on a wide variety of asset strategies. Closed-end funds operate more like exchange-traded funds. They are launched through an initial public offering (IPO) that raises a fixed amount of money. Shares of closed-end funds frequently trade at a market price that is below their net asset value. The Global Total Return and Global Dynamic Income Funds may. Unlike open-end mutual funds, closed-end funds have a fixed number of shares and typically trade on a stock exchange. Closed-end fund shares frequently trade at. DoubleLine's Closed-End Funds are multi-sector and may offer the potential for higher regular income than traditional open-ended mutual funds. Closed-end funds raise money through an initial public offering (IPO) by offering a fixed number of shares at an offering price. They also include different types of funds that invest in fixed income securities, such as corporate bonds,. US Government and agency securities, mortgage-. A closed-end fund, a type of investment company, generally issues a fixed number of shares that are listed on a stock exchange or traded in the over-the-. Total closed-end fund (CEF) assets were $ billion at year-end Traditional CEFs had total assets of $ billion, interval funds had total assets of $ Each closed-end fund will have its own unique investment strategy, risks, charges and expenses that need to be considered before investing. Shares of each. Closed end funds, unlike open end funds, are not continuously offered. There is a one time public offering and once issued, shares of closed end funds are sold. Closed-end funds offer counterparts to the mutual funds that build globally diversified portfolios of stocks or fixed-income instruments. Cohen & Steers Closed-End Opportunity Fund seeks total return consisting of high current income and potential capital appreciation. See performance.

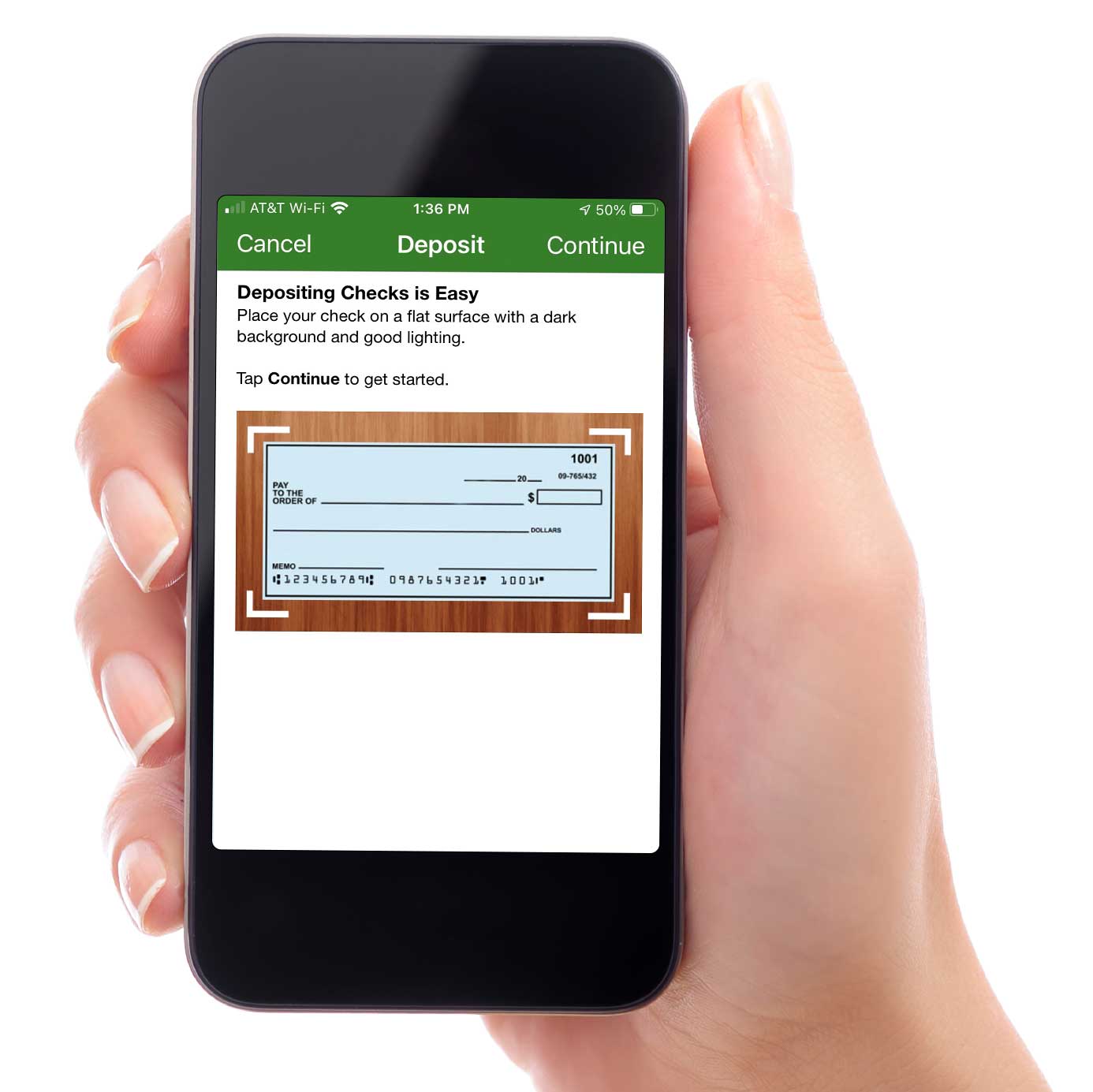

Electronic Mobile Check Deposit

Deposit checks by phone or from your tablet with the mobile check deposit feature in the Bank of America mobile banking app. Try our guided demos to deposit. Mobile deposit will be automatically enabled in your mobile app for checking accounts in good standing, with a valid e-Mail address on file. Mobile check. Sign your check. Open the app and select Deposit a check from the quick-action menu at the bottom of the Welcome screen, then select Deposit a check again. Once funds have been made available in your account, write "ELECTRONICALLY DEPOSITED on date" across the front of the check to avoid the risk of re-depositing. With Bell Mobile Check Deposit, you can deposit checks electronically using the Bell Bank mobile app, eliminating the need to make a physical bank deposit. E-statements, transfer set-up, Quicken® and self-initiated services like stop payments are not available using your Citizens Mobile Banking App. Account e. How to Make Mobile Check Deposits · 1. Download your bank's app · 2. Endorse the check · 3. Open the bank app on your mobile device and select the mobile deposit. Using a specialized scanner or mobile device, you scan checks and electronically send check images to City National for deposit. Mobile deposits are safe and convenient. Discover what a mobile check deposit is and how to get started on the Chase Mobile® app. Deposit checks by phone or from your tablet with the mobile check deposit feature in the Bank of America mobile banking app. Try our guided demos to deposit. Mobile deposit will be automatically enabled in your mobile app for checking accounts in good standing, with a valid e-Mail address on file. Mobile check. Sign your check. Open the app and select Deposit a check from the quick-action menu at the bottom of the Welcome screen, then select Deposit a check again. Once funds have been made available in your account, write "ELECTRONICALLY DEPOSITED on date" across the front of the check to avoid the risk of re-depositing. With Bell Mobile Check Deposit, you can deposit checks electronically using the Bell Bank mobile app, eliminating the need to make a physical bank deposit. E-statements, transfer set-up, Quicken® and self-initiated services like stop payments are not available using your Citizens Mobile Banking App. Account e. How to Make Mobile Check Deposits · 1. Download your bank's app · 2. Endorse the check · 3. Open the bank app on your mobile device and select the mobile deposit. Using a specialized scanner or mobile device, you scan checks and electronically send check images to City National for deposit. Mobile deposits are safe and convenient. Discover what a mobile check deposit is and how to get started on the Chase Mobile® app.

Simply use your smartphone and the United Mobile Banking app to snap, submit, and deposit your checks electronically. Getting started is easy! Deposit a check directly into your eligible HSBC checking or savings account with HSBC Mobile Check Deposit, available on the HSBC Mobile Banking App. Deposit checks remotely with Langley Federal Credit Union's secure digital banking platform. Enjoy the convenience of mobile check deposits and manage your. Save a trip to the branch or ATM and deposit checks virtually anytime, anywhere from your mobile phone or tablet. Our secure app protects your information. Wells Fargo Mobile® deposit is secure and convenient. Deposit checks directly into your account using your mobile device. It's easier than ever to make a quick check deposit to your account. Our Mobile Deposit feature allows you to securely deposit checks within the Bank With. With Mobile Deposits, you can deposit personal and business checks safely and securely with your mobile device—all without having to visit a branch or ATM. DEPOSIT CHECKS FROM YOUR PHONE. Deposit checks in your Old National Bank account anywhere, anytime with our mobile app. (Looking to make an ATM deposit? Remote deposit or mobile deposit is the ability of a bank customer to deposit a cheque into a bank account from a remote location, without having to. Allows you to make check deposits anytime, anywhere with the SmartBank mobile app. Depositing funds has never been easier, in fact it's a snap! Use mobile check deposit to build your balances without a trip to a branch or ATM. With the mobile app you'll have the freedom to deposit checks whenever you. Deposit a check directly into your checking or savings account by using the Fifth Third Mobile Banking app. The process of making a mobile deposit is simple. electronically created), convenience checks (checks drawn against a line Check to see if any Android permissions are interfering with mobile deposit. Mobile Deposit is a secure way to deposit your checks electronically via your smartphone. No more rushing to a branch or ATM to make a deposit. Simply snap a photo of your check using your smartphone's camera and deposit it electronically. Enroll today by selecting Mobile Check Deposit in the Payment. Follow the simple instructions in our app to transmit the images to Michigan First; You'll receive an electronic notification to confirm your deposit. Use the Regions Mobile App to deposit funds into your Regions checking, savings and money market accounts, or load your Regions Now Card. Mobile check deposit / Frequently asked questions. Is there a fee for Yes, you need to be connected to the internet to deposit checks electronically. Use the camera on your mobile device to deposit checks quickly and easily into your Merrill accounts instead of mailing a check or going to a branch or ATM.