peyk.site

Prices

How Do I Start Trading Cryptocurrency

Trade bitcoin and other digital currencies for the first time by following the steps below. You'll learn about popular crypto assets, how to set up a wallet. Register on a Legit Crypto Exchange Before trading crypto, use a good crypto exchange that ensures the safety of funds and provides a good trading experience. First off, you need to trade larger amounts, at least hundreds but usually thousands of dollars per trade to make enough profit to offset. To start investing in crypto, investors must first create an account with a broker. Brokers have online trading platforms that enable investors to buy and sell. People must select a cryptocurrency wallet and an exchange before they can begin trading. start trading in well-known coins like Bitcoin or Ethereum. Instead of purchasing cryptocurrencies on an exchange, you can trade with CFDs on them, speculating on price movements without owning any. Why start investing. Trading Crypto · 2. PICK A CRYPTOCURRENCY TO TRADE · 3. OPEN A TRADING ACCOUNT · 4. CREATE A TRADING PLAN. How do you start trading cryptocurrencies? If you want to get started trading cryptocurrencies, you can open an account and fund it with your fiat currency. For beginners in crypto trading: a. Start by researching and understanding cryptocurrencies, blockchain technology, and different trading strategies. Trade bitcoin and other digital currencies for the first time by following the steps below. You'll learn about popular crypto assets, how to set up a wallet. Register on a Legit Crypto Exchange Before trading crypto, use a good crypto exchange that ensures the safety of funds and provides a good trading experience. First off, you need to trade larger amounts, at least hundreds but usually thousands of dollars per trade to make enough profit to offset. To start investing in crypto, investors must first create an account with a broker. Brokers have online trading platforms that enable investors to buy and sell. People must select a cryptocurrency wallet and an exchange before they can begin trading. start trading in well-known coins like Bitcoin or Ethereum. Instead of purchasing cryptocurrencies on an exchange, you can trade with CFDs on them, speculating on price movements without owning any. Why start investing. Trading Crypto · 2. PICK A CRYPTOCURRENCY TO TRADE · 3. OPEN A TRADING ACCOUNT · 4. CREATE A TRADING PLAN. How do you start trading cryptocurrencies? If you want to get started trading cryptocurrencies, you can open an account and fund it with your fiat currency. For beginners in crypto trading: a. Start by researching and understanding cryptocurrencies, blockchain technology, and different trading strategies.

One major benefit of trading cryptocurrency CFDs is that a relatively small amount of money, like $, can be enough to kickstart a trading journey. This is. 1. Obtain proper legal counsel to ensure licensing requirements are met. 2. Attain funding for venture. 3. Find a cryptocurrency exchange software solution. Step 4: Buy Crypto · Go to your exchange's website or mobile app and log into your account. · Navigate to the trading terminal where you can buy and sell crypto. A beginner's guide to crypto trading strategies · HODLing. HODL is a word derived from a fortuitous misspelling of “hold” by a poster on the Bitcoin Talks online. When you buy cryptocurrencies via an exchange, you purchase the coins themselves. You'll need to create an exchange account, put up the full value of the asset. However, investors must understand that cryptocurrency trading is entirely anonymous. Step 5: Store your Cryptocurrency. Cryptocurrencies are stored in. Just create an account at Kriptomat or another exchange and begin trading. It's more accessible and more exciting than trading stock, gold, or soybean futures. Trade in minutes from only €1. Your No.1 European broker for stocks, crypto, indices, ETFs and precious metals. Trade 24/7. Fee-free on all deposits. crypto trading features. Start trading through one of our external partners today. bitgo logo. Leading digital asset wallet solutions since You can even start from just $ Crypto trading, like any form of investment, carries inherent risks, and prices in the cryptocurrency market. Understand what crypto trading is. · Learn why people trade cryptos. · Pick a cryptocurrency to trade. · Open a CFD trading account. · Identify. Move your mouse over Exchange and click on Basic. Selecting Basic Cryptocurrency Trading method; On the right of the page, click on BTC and enter NEO (or the. Another strategy, possibly tailored towards cryptocurrency trading for beginners, is more 'buy and hold' in nature. This involves buying crypto and waiting. Passive investors buy and sell cryptocurrency coins like Bitcoin (BTC) or Ether (ETH) directly through cryptocurrency exchange venues. Active traders can buy. The first step in cryptocurrency trading is to find a suitable cryptocurrency trading platform and create an account. Different cryptocurrency traders have. This article is an educational guide to CFD trading and the financial markets and should not be considered as advice. Understand what crypto trading is. · Learn why people trade cryptos. · Pick a cryptocurrency to trade. · Open a CFD trading account. · Identify. To start investing in crypto, investors must first create an account with a broker. Brokers have online trading platforms that enable investors to buy and sell. Pay attention to stock market trading hours as they have an effect on cryptocurrency trading, even though you can buy and sell cryptocurrencies 24/7. Be.

How To Invest Your First $1000

5 Ways to Invest Your First $ · 1. Robo-advisors. Robo-advisory platforms have been gaining traction worldwide, and for good reason. · 2. Regular savings. Minimum balance requirement of just $1,; Fast and secure online enrollment your transactions to manage your investments. Click here to view Ford. Setting clear financial goals, like saving for retirement or a down payment on a house, and a time horizon can help you decide how to invest $1, You can. Another great way to get started investing with a smaller initial investment is through real estate crowdfunding. Crowdfunding is the act of raising cash for. If you have an extra $ and are ready to dip your toe into investing The smartest way to invest your first $1,, according to a wealth. 1. Online trading platforms · 2. Lend to those in need and earn some interest · 3. Find a robo-advisor · 4. Invest in your kids' college education · 5. Pay down. 7 Ways to Invest $1, · 1. Pay Down Debt · 2. Invest in an ETF or Index Fund · 3. Use Target-Date Funds · 4. Try a Robo-Advisor · 5. Low-Risk Debt Instruments · 6. The good news is that you no longer have to have a ton of money to get into the stock market. With an investing app called Stash, you can invest in virtually. Find the cheapest possible way to put it into an index fund, like the SPY - S&P Index, and let it grow. That could be via a mutual find from. 5 Ways to Invest Your First $ · 1. Robo-advisors. Robo-advisory platforms have been gaining traction worldwide, and for good reason. · 2. Regular savings. Minimum balance requirement of just $1,; Fast and secure online enrollment your transactions to manage your investments. Click here to view Ford. Setting clear financial goals, like saving for retirement or a down payment on a house, and a time horizon can help you decide how to invest $1, You can. Another great way to get started investing with a smaller initial investment is through real estate crowdfunding. Crowdfunding is the act of raising cash for. If you have an extra $ and are ready to dip your toe into investing The smartest way to invest your first $1,, according to a wealth. 1. Online trading platforms · 2. Lend to those in need and earn some interest · 3. Find a robo-advisor · 4. Invest in your kids' college education · 5. Pay down. 7 Ways to Invest $1, · 1. Pay Down Debt · 2. Invest in an ETF or Index Fund · 3. Use Target-Date Funds · 4. Try a Robo-Advisor · 5. Low-Risk Debt Instruments · 6. The good news is that you no longer have to have a ton of money to get into the stock market. With an investing app called Stash, you can invest in virtually. Find the cheapest possible way to put it into an index fund, like the SPY - S&P Index, and let it grow. That could be via a mutual find from.

The best ways to invest $1, right now · 1. Stocks and ETFs · 2. Use a robo-advisor · 3. Chip away at high-interest debt · 4. Use real estate crowdfunding sites. 1. Dive Into the Stock Market With Index Funds · 2. Embrace Diversification With ETFs · 3. Bet on Yourself: Invest in Personal Development · 4. Secure Your Future. The good news is that you no longer have to have a ton of money to get into the stock market. With an investing app called Stash, you can invest in virtually. How To Invest Your First $ in (Step by Step) · You need to consider what your financial goals are. · Evaluate your risk tolerance and appetite for your. Open a Roth IRA at Fidelity, and put half into FZROX and half into FXAIX. They're cheaper than Vanguard, and do the same thing. Don't worry. With the introduction of the first savings bonds, regular citizens were able to invest This committee encouraged workers to automatically invest a. Low-risk options generally yield more stable, but slower, growth. Consider options like a high-yield savings account, low-cost index funds, or. Peer-to-peer lending is a hot investment strategy these days. While you might not get rich investing in a peer-to-peer lending network, you could definitely. By keeping your costs low, you'll have better chances of growing your money. Finhabits uses low-cost index funds by reputable firms such as Vanguard or. What other investments can you hold? · Cash (money): · Guaranteed investment certificates (GICs): · Exchange-traded funds (ETFs): · Mutual funds: · Bonds: · Stocks . At WallStreetSurvivor, we love with the stock market and we are obsessed with finding the best deals to help us all make more money. Here is our list of the. How To Invest Your First $ in (Step by Step) · You need to consider what your financial goals are. · Evaluate your risk tolerance and appetite for your. Ready to invest your first $? Start with opening a brokerage account and consider investing in an Exchange-Traded Fund (ETF) like the S&P for. Most Vanguard mutual funds have a $3, minimum, but you can invest in any Vanguard Target Retirement Fund or Vanguard STAR® Fund with as little as $1, . By keeping your costs low, you'll have better chances of growing your money. Finhabits uses low-cost index funds by reputable firms such as Vanguard or. A Step-by-Step Guide on How to Invest Your First $ · Stocks: Stocks represent ownership in companies. Investing in stocks can offer high. 1. Dive Into the Stock Market With Index Funds · 2. Embrace Diversification With ETFs · 3. Bet on Yourself: Invest in Personal Development · 4. Secure Your Future. Saving your first $1, gives you a cushion for emergencies. It can also help you build good saving habits that lay the groundwork for a solid future as well. Buy 1 or more funds or ETFs—Mutual funds and ETFs are packages of stocks and bonds, almost like a prefilled grocery basket you can buy. You can use them like. For investors who are either young and/or just starting out, we typically recommend building up the core portfolio first. Core investment solutions tend to be.

Watch Video Earn Paypal

Are streaming prices to high?! try streamEarn and start to Earn paypal money with our income app. Win free PayPal cash and PayPal gift cards. watching videos, reaching a certain in-game level and much more. This amazing community can help you to complete the offers fast and earn more money. In this. Here's an easier way to earn rewards while watching videos. TubePay allows users to earn rewards with their phones. If you like watching videos and want to. Video games are full of thrills, but fumbling with a thumbstick to enter You can still earn your credit card reward points. Spending your money. Watch captivating videos but also earn rewards with cash incentives and PayPal cash for your time. Say goodbye to idle screen time and hello to a lucrative. From paying friends to saving money or getting cash back when you shop, explore what the new PayPal app has to offer. Become a Streamer Join a platform like Twitch or Stream and start your live streaming journey. You can earn money as you watch videos and share your reactions. Earn FREE PayPal Money by answering paid surveys, playing games, or watching videos. Sign up now and get started! When you watch a video for just over 1 minute, you earn $3. You can watch it on your mobile phone or computer. Once you reach $7, you can cash. Are streaming prices to high?! try streamEarn and start to Earn paypal money with our income app. Win free PayPal cash and PayPal gift cards. watching videos, reaching a certain in-game level and much more. This amazing community can help you to complete the offers fast and earn more money. In this. Here's an easier way to earn rewards while watching videos. TubePay allows users to earn rewards with their phones. If you like watching videos and want to. Video games are full of thrills, but fumbling with a thumbstick to enter You can still earn your credit card reward points. Spending your money. Watch captivating videos but also earn rewards with cash incentives and PayPal cash for your time. Say goodbye to idle screen time and hello to a lucrative. From paying friends to saving money or getting cash back when you shop, explore what the new PayPal app has to offer. Become a Streamer Join a platform like Twitch or Stream and start your live streaming journey. You can earn money as you watch videos and share your reactions. Earn FREE PayPal Money by answering paid surveys, playing games, or watching videos. Sign up now and get started! When you watch a video for just over 1 minute, you earn $3. You can watch it on your mobile phone or computer. Once you reach $7, you can cash.

Earn PayPal for Doing Surveys Get $1Bonus peyk.site?ref= Minimum Cash out Ønly at $ watching videos. Earn points that you can redeem for PayPal cash or gift cards. Earning activities including shopping online (cash back rebates), searching. Watch video and reels win free rewards. Redeem your points with PayPal cash and Amazon Gift card. Try this legit and free app. No need to purchase gems. You can earn PayPal money by watching videos, completing surveys and other easy tasks. Watch videos and get paid extra cash today! You can also receive cash from PayPal. In addition to this, it offers a 10 USD bonus for signing up on its site. 2. InboxDollars. Make real money by doing simple tasks in the app. Easily make money for free by watching videos. We offer PayPal payouts that are fast! Cash out your earnings through PayPal or win fantastic prizes like cars, watches, and Amazon gift cards. To earn more tokens, you can watch video ads that are. 5. Cash Out Easily: Once your earnings hit the $7 mark, you have the freedom to cash out through PayPal, opt for Bitcoin, or choose gift cards. Take paid surveys, try new products, watch videos, and play free games. Cash out with PayPal when you're ready. Earn Cash Rewards via PayPal. Earn Free PayPal. Users can choose to cash out via PayPal or redeem their points for gift cards. One hundred Swagbucks equals $1. Swagbucks notes that some committed users have. Get paid with PayPal, gift cards, or cash. Just Binge Watch and Chill. It's easy. You already watch videos and TV shows while you're scrolling through your. How do I get paid $50 per hour to watch YouTube videos? 2, Views 1)Take paid Surveys online: You can earn paypal money fast BY. I downloaded said app and it took me 3 whole days to reach level 5. Absolutely ridiculous. I honestly just watch the 37 videos a day that it gives me and redeem. Where can I get money by watching videos or ads and get paid by any methods because I don't have PayPal? Watch entertaining videos, simple online tasks, surf the web, shop online, and answer paid surveys from popular survey sites. Each task or paid survey you. Earn money from home, get paid for listening to music, playing games, watching twitch streams and taking surveys. Redeem Paypal, Bitcoin and Gift Cards for. watch videos, shop online, answer surveys, and play games—all of which earn you points. Then, you can redeem your points for gift cards or cash back through. PayPal $25 by taking surveys, shopping, playing games, and watching videos Earn money online and PayPal cash when you complete paid online surveys, make. 52 votes, 56 comments. I'm in the US and looking for an app that pays you PayPal gift cards and doesn't make you watch videos after videos. Earn $5 Per Video You Watch (Make PayPal Money Online For Free). / 15 seconds. 15 seconds.

Line Of Credit For Fair Credit Score

A fair credit score is generally considered a FICO score between and Borrowers with fair credit tend to pose more risk for the lender, so they may find. Upstart looks beyond your credit score when it comes to personal loans, credit card debt consolidations, and more. You have ample opportunity to improve a bad. Personal loans for fair credit are for borrowers with credit scores from to Compare rates and terms at online lenders offering loans up to $ This tool shows the maximum possible credit line you can obtain based on your home value, existing mortgage loans, and the maximum combined loan-to-value (CLTV. Truist's unsecured personal line of credit allows for easy access to funds to help cover financial gaps & expenses. Credit lines start at $ Line of Credit · Borrow as little as $ up to $5, · Low monthly payment · Overdraft protection option available · Access credit by debit card, digital banking. Credit Cards for Fair Credit · Capital One Platinum Credit Card · Fortiva® Mastercard® Credit Card · PREMIER Bankcard® Mastercard® Credit Card · Destiny Mastercard®. A “Fair” credit score is between – For a home equity loc is about as low as you can go to be qualified and some lenders actually. Credit Cards for Fair Credit · Capital One Platinum Credit Card · Fortiva® Mastercard® Credit Card · PREMIER Bankcard® Mastercard® Credit Card · Destiny Mastercard®. A fair credit score is generally considered a FICO score between and Borrowers with fair credit tend to pose more risk for the lender, so they may find. Upstart looks beyond your credit score when it comes to personal loans, credit card debt consolidations, and more. You have ample opportunity to improve a bad. Personal loans for fair credit are for borrowers with credit scores from to Compare rates and terms at online lenders offering loans up to $ This tool shows the maximum possible credit line you can obtain based on your home value, existing mortgage loans, and the maximum combined loan-to-value (CLTV. Truist's unsecured personal line of credit allows for easy access to funds to help cover financial gaps & expenses. Credit lines start at $ Line of Credit · Borrow as little as $ up to $5, · Low monthly payment · Overdraft protection option available · Access credit by debit card, digital banking. Credit Cards for Fair Credit · Capital One Platinum Credit Card · Fortiva® Mastercard® Credit Card · PREMIER Bankcard® Mastercard® Credit Card · Destiny Mastercard®. A “Fair” credit score is between – For a home equity loc is about as low as you can go to be qualified and some lenders actually. Credit Cards for Fair Credit · Capital One Platinum Credit Card · Fortiva® Mastercard® Credit Card · PREMIER Bankcard® Mastercard® Credit Card · Destiny Mastercard®.

Some of the best lenders to consider for a $15, loan with fair credit include LightStream, American Express, SoFi and Wells Fargo. Just about any lender that. 5 personal loans for a credit score · Avant: Best for all credit types · Best Egg: High approval rates if you prequalify · OneMain Financial: Best bad credit. Adding a co-signer for your loan is another way to help you get approved if you have bad credit. Using a co-signer with good credit may also enable you to get. Happy Money, for example, requires a FICO score of or higher for approval. While lenders might approve loans to consumers with a wide range of scores, the. Best for people without a credit history: Upstart Personal Loans · Best for debt consolidation: Happy Money · Best for flexible terms: OneMain Financial Personal. Having difficulty getting approved for a credit card? The Avant Credit Card may be an option if you have a fair or average credit score. Apply online today. Potential borrowers with bad credit can apply for a personal Line of Credit through an online lender. Many lenders either operate entirely online or offer. Borrow as much or as little as you need up to your credit limit. Requires no collateral and can be used for almost anything — use the money for home improvement. A personal line of credit is tied to your checking or money market account and may provide nonsufficient funds (NSF) and overdraft protection. Exclusive to U.S. Bank personal checking clients, take on your home improvement projects with the flexibility of a credit card, but typically with lower. Additionally, a fair credit score may not even get you in the door with some lenders. Or, if a lender does accept loan applications from fair credit borrowers. U.S. Bank clients with a FICO® Score of or above and other qualifying factors could receive funds within hours. Check your rate & apply. First, double check your credit score. Make sure that you are considered within the “fair” range of credit scores—generally between and If you're below. A new credit card or line of credit will also affect your length of credit history. This part of your score is made up of your "oldest" account and the average. Also like a loan, using a line of credit responsibly can improve a borrower's credit score. You can use funds from personal loans and lines of credit for. Achieving a good credit score can help you qualify for a credit card or loan with a lower interest rate and better terms. That said, different lenders use their. Personal credit above FICO® Score is typically required · At least 2 years in business under existing ownership · $, or more in annual revenue. Fair credit can be a barrier to approval with some personal loan companies, but not all. Lenders may rely heavily on your credit score to determine whether. Lenders consider your credit scores as a significant factor when deciding whether to approve you for a personal loan and at what terms.

When Should I Get A Car

Follow these tips to find your first set of wheels—and to understand all the costs and considerations. The time and mileage intervals can vary based on the type of vehicle that you drive, both make and model. If your vehicle is in high demand, you could get more money for it than usual. It will help defray the costs of buying another car, whether it's new or used. If assignment on title does not have section for sales price, a bill of sale must accompany paperwork. Completed Title Application (SCDMV Form ) · Title. Best age to buy a car in between 23– As it will lead to turn you in high class and will give you social status and mental happiness. The idea of a brand new car is exhilarating, but for most people, used cars are more budget friendly and just make more sense. If you aren't convinced that a. How Does A Car Loan Affect Your Ability To Get A Mortgage? When reviewing a home buyer's credit-worthiness, lenders look at all existing loans: car loans. The end of the month is, indeed, the best time to buy a new car from a dealership. Even better, you might consider buying a car at the end of a quarter. Pre-approval for car loans is typically honored for days. That being said, you don't have to wait long after beginning the pre-approval process to start. Follow these tips to find your first set of wheels—and to understand all the costs and considerations. The time and mileage intervals can vary based on the type of vehicle that you drive, both make and model. If your vehicle is in high demand, you could get more money for it than usual. It will help defray the costs of buying another car, whether it's new or used. If assignment on title does not have section for sales price, a bill of sale must accompany paperwork. Completed Title Application (SCDMV Form ) · Title. Best age to buy a car in between 23– As it will lead to turn you in high class and will give you social status and mental happiness. The idea of a brand new car is exhilarating, but for most people, used cars are more budget friendly and just make more sense. If you aren't convinced that a. How Does A Car Loan Affect Your Ability To Get A Mortgage? When reviewing a home buyer's credit-worthiness, lenders look at all existing loans: car loans. The end of the month is, indeed, the best time to buy a new car from a dealership. Even better, you might consider buying a car at the end of a quarter. Pre-approval for car loans is typically honored for days. That being said, you don't have to wait long after beginning the pre-approval process to start.

Typically, a bank offers a better deal, like lower interest rates and lower fees in the long run, and a bank won't pressure you to buy a car outside your. What are the different types of car leases? When is it best to lease a car? When does it make sense to buy or finance a new car? Lease vs finance FAQs. But how large should your down payment be if you have a negative credit history? Because a down payment can provide a helpful counterweight to low credit. I'm 16 years old and I've had my license for about 6 months now. I'm just curious how many of you acquired the money to own your first car. Pros: Cars are associated with personal freedom for a reason. Having a car means you can go wherever you want, whenever you want, without having to check bus. Take a test drive; Get a pre-purchase inspection; Get a VIN Check; Get the history; Questions you should ask; Negotiate the price; Get car insurance. It depends on your priorities, experience, and availability. Buying a car through a private seller is going to require more intensive research. Key Takeaways · New cars come with the latest safety features and are very likely to be reliable, though they can come with a higher price tag and insurance. Know your rights and some information about the car-buying process before you start shopping. This article covers some of the most important things to know. Bring some excitement to the new car search process by trying MotorTrend's Car Match feature. By using our Ultimate Car Rankings system, we make sure your. 1. Know what rate you're approved for. Determining how you'll finance your car should be one of your top priorities before you make your final car selection. If your purchase does not qualify for a title certificate, the ownership proof is a transferable registration signed over to you. Proofs of ownership. VEHICLE. The biggest benefit of buying a car online is the time you'll save compared to going to a dealership—or, in many cases, going from one dealership to another in. Not to mention that with a lease, you always have a recent vehicle covered by a warranty. However, you should know that with leasing, you are not adding any. We have made a list of seven reasons why you should consider to buy a used cars instead of looking up car ads for new cars. Whether you're 16 or 60, buying a used car can be an exciting experience. But it can also be a big financial commitment, with some industry reports. The rule of thumb is to put down 20 percent of the value of the car. This amount is large enough to keep you from going underwater, but not large enough to. When you buy a car under an LLC, you could end up paying more money in the long run. For example, interest rates for business-related loans tend to be. If you enjoy having the latest technology, prioritize cutting-edge safety features, can afford a new car, or want the benefits of a warranty and lower financing. Used cars have the obvious advantage of being much less expensive. The immediate loss in the value of the vehicle has already been absorbed by the time you.

Want Loan For Business

Financial institutions provide commercial loans for most types of business. Government loans come from funding programs with specific rules about who can get a. Two of the most common methods of getting a six-figure business loan are applying through a bank and consulting an alternative lender. OnDeck supports small businesses with a variety of loan options for any business need. Learn why OnDeck is the right lender with loan amounts up to $K. Call us. Talk to a Small Business specialist at , opens in new tab. Unsecured loan amount, not to exceed two (2) months gross revenue or one (1). Associated Bank makes it fast and easy to apply for a small business loan. Apply for a small business loan today or schedule an appointment with one of our. 1. Write a business plan · 2. Choose a type of business loan or financing · 3. Compare lenders and determine if your business qualifies · 4. Prepare your documents. Both personal loans and small business loans are effective ways to cover expenses to get your small business off the ground. Your choice may come down to how. When seeking out a business loan, you want one with a low interest rate, if possible. Depending on the type of loan, you may see rates range anywhere from 3. “With personal loans, on the other hand, you don't have to show any business interest to be approved for a loan.” But before applying for a personal loan, you. Financial institutions provide commercial loans for most types of business. Government loans come from funding programs with specific rules about who can get a. Two of the most common methods of getting a six-figure business loan are applying through a bank and consulting an alternative lender. OnDeck supports small businesses with a variety of loan options for any business need. Learn why OnDeck is the right lender with loan amounts up to $K. Call us. Talk to a Small Business specialist at , opens in new tab. Unsecured loan amount, not to exceed two (2) months gross revenue or one (1). Associated Bank makes it fast and easy to apply for a small business loan. Apply for a small business loan today or schedule an appointment with one of our. 1. Write a business plan · 2. Choose a type of business loan or financing · 3. Compare lenders and determine if your business qualifies · 4. Prepare your documents. Both personal loans and small business loans are effective ways to cover expenses to get your small business off the ground. Your choice may come down to how. When seeking out a business loan, you want one with a low interest rate, if possible. Depending on the type of loan, you may see rates range anywhere from 3. “With personal loans, on the other hand, you don't have to show any business interest to be approved for a loan.” But before applying for a personal loan, you.

A solid business plan, good credit, and top of your class education aren't enough to get a loan. Don't ever go into business thinking you can. Need funds for your business? We offer loans up to $ for debt consolidation, inventory purchase, equipment purchase, working capital, and more. If the loan is for an existing business, the lender will want two years of profit and income statements and possibly tax returns. The budget should be realistic. U.S. Bank business loan options can be used to cover operating expenses, maintain inventory, pay vendors and more. Backed by the strength and stability of. To be eligible for financing under SBA's 7(a) loan program, the applicant business must meet all of the following: Meet SBA size standards; Be for-profit; Not. Find Your Funding Solution ; Term Loans. Best if: You want predictable monthly payments. A traditional financing option ; Lines of Credit. Best if: You need. Online and Alternative Small Business Loans · Term Loan · Invoice Financing (also known as “accounts receivable financing”) · Inventory Financing · Merchant Cash. A Small Business Loan can help you purchase business assets or finance expansion plans. Fixed or floating interest rates are available for Small Business. Wells Fargo has something for any small business, including business credit cards, loans, and lines of credit. Visit Wells Fargo online or visit a store to. Best for businesses that want an unsecured term loan, with a simplified application and decisioning process. This type of operating loan supports a temporary business need and is generally expected to be repaid within a year from receiving the loan. Select Credit. Get a small business loan in Canada with affordable rates, fast approval times and flexible repayment options. Funded by thousands of investors. If you don't want your personal assets to be at stake, a business loan without a personal guarantee is going to be a better option than a personal loan. Some. Research the lender in advance and keep in mind there are typically no up-front application fees for a business loan. Understanding your credit score. What Do You Need to Get a Startup Business Loan? · A business plan · Statements · Business registration · Employer identification number (EIN) · Personal credit. The amount you can borrow also depends on personal factors such as your credit score, debt-to-income ratio and business revenue. You'll usually be able to. The 7(a) loan program is SBA's primary program for providing financial assistance to small businesses and is the most widely used loan program of the Small. Small business loans function like many other business loans – a lender provides a sum of money which is paid back over time. The loan may be secured or. How does PayPal Business Loan work? You must complete a minute online questionnaire to determine your business's eligibility. Your application may take. Research the lender in advance and keep in mind there are typically no up-front application fees for a business loan. Understanding your credit score.

How To Cold Call In Person

Lead Generation | Appointment Setting | Cold · An in-person visit requires non-productive travel time. · If you happen to catch a prospect who is. “A sales method during which a salesman calls people that haven't indicated an interest in their products. Cold calling is typically related to phone or. ▪️ Take a deep breath before speaking. You can also visualize your call and use some mantras like: “I'm good at talking with new people.”, “Callers don't reject. When you are cold calling people, you want the first thing you say about your company or your product to be short, catchy and give the person you're calling. – Which would you ratherhave – cold calls or referrals? People have to cold call because theyare transactional with customers (they have a hunter –. Sales cold calls are not usually stand-out events, either for the person making the call or the person receiving it. After the receptionist writes (or. SCHEDULE ALL SALES CALLS. The biggest mistake screen printers make with in-person calls is not scheduling them. · DO YOUR RESEARCH. A successful sales call. Lead Generation | Appointment Setting | Cold · An in-person visit requires non-productive travel time. · If you happen to catch a prospect who is. Make a strong first impression when opening the cold call · Have a strong introduction · Lead the call · Showcase your company's credibility · Lead Generation | Appointment Setting | Cold · An in-person visit requires non-productive travel time. · If you happen to catch a prospect who is. “A sales method during which a salesman calls people that haven't indicated an interest in their products. Cold calling is typically related to phone or. ▪️ Take a deep breath before speaking. You can also visualize your call and use some mantras like: “I'm good at talking with new people.”, “Callers don't reject. When you are cold calling people, you want the first thing you say about your company or your product to be short, catchy and give the person you're calling. – Which would you ratherhave – cold calls or referrals? People have to cold call because theyare transactional with customers (they have a hunter –. Sales cold calls are not usually stand-out events, either for the person making the call or the person receiving it. After the receptionist writes (or. SCHEDULE ALL SALES CALLS. The biggest mistake screen printers make with in-person calls is not scheduling them. · DO YOUR RESEARCH. A successful sales call. Lead Generation | Appointment Setting | Cold · An in-person visit requires non-productive travel time. · If you happen to catch a prospect who is. Make a strong first impression when opening the cold call · Have a strong introduction · Lead the call · Showcase your company's credibility ·

B2B cold calling is usually targeted at businesses that find value in the product or service being sold. With B2B cold calls, the target is often a decision-. People ignore emails, but it's hard to put the phone down to another human being. Cold calling allows you to quickly move through a list of prospects and get. Not all cold calls are truly cold. Sometimes leads are generated by referrals or because the person requested more information by filling out an online form. Before picking up the phone, use online research, LinkedIn (or other sources) to find a common point of connection between you and the person you are about to. How It Will Help You · Use effective power phrases to gain appointments · Be poised and confident when cold calling · Use language that gets prospects excited. Listen: A sales call is a two-way conversation, so make sure to listen to the person you're speaking with. This will help you tailor your pitch and build. When attempting to contact the key person, avoid leaving voice mail messages the first two times you call. Unfortunately, it's relatively rare that people who. 1. Greet the prospect Many B2B salespeople jump straight into business, forgetting to greet the person on the other end. This can leave a bad impression on. In essence cold calling is the art of approaching someone, professionally, openly and meaningfully, with a sensible proposition. All great entrepreneurs and. The purpose of cold calling is to move from an interruption into a scheduled meeting where you will have the prospect's undivided attention. How do expert. B2B cold calling is usually targeted at businesses that find value in the product or service being sold. With B2B cold calls, the target is often a decision-. That means finding information about the person you are reaching out to and the company they work for. That way, you can know in advance if you're about to call. Show genuine interest in what the other person is saying. Ask meaningful follow-up questions that go beyond probing for qualifications. Be authentic as you. Cold calling technique refers to solicitation of a prospect through different channels — telephone or person—without having any prior contact with the. Cold calling is making contact with a prospective customer or client with who you have had no previous interaction before. While we generally think of cold. This helps you become more comfortable and remember what to say during your actual call. Consider asking someone to listen to your script to let you know if you. The standard cold call format includes a cold opener that states the reason for calling, a quick elevator pitch, a brief needs assessment, and then any. “A sales method during which a salesman calls people that haven't indicated an interest in their products. Cold calling is typically related to phone or. The standard cold call format includes a cold opener that states the reason for calling, a quick elevator pitch, a brief needs assessment, and then any.

How Long Does Your Ovulation Period Last

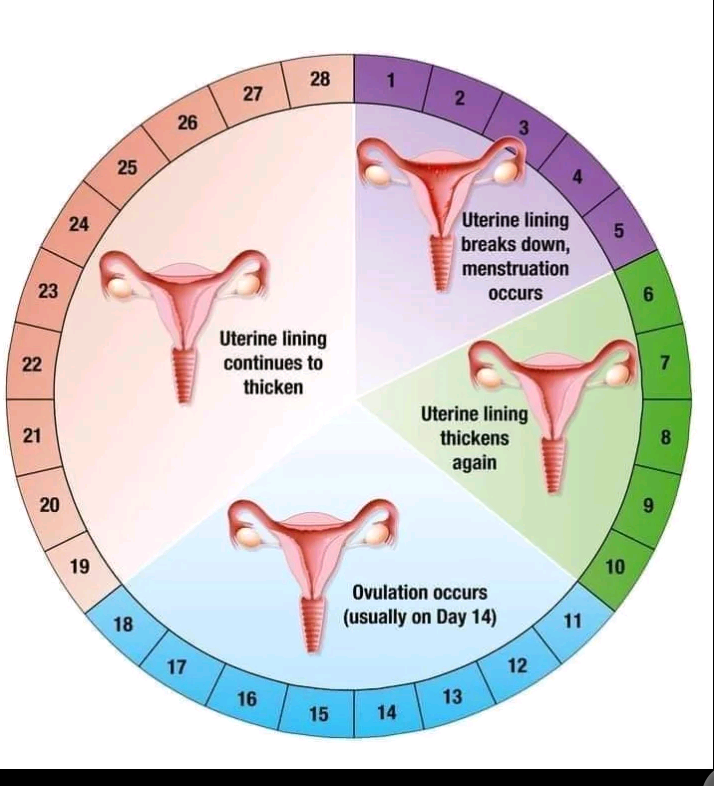

Ovulation is a major event in the menstrual cycle (1). It occurs when hormones cause the release of an egg from one ovary, into your fallopian tube (2). Like. How does the menstrual cycle work? · Your cycle starts on the first day of your period and continues up to the first day of your next period. · This is 28 days on. Ovulation usually happens once each month, about two weeks before your next period. Ovulation can last from 16 to 32 hours. Ovulation does not happen if you are. Track how long it occurs. Ovulation pain can last for a few minutes up to a couple of days (1). Clue has found that the majority of people who track. These are called “dry days,” and they may be safe days if your cycle is long. Before ovulation is about to happen, your body makes more mucus as an egg starts. A step-by-step guide to conception. After ovulation the egg lives for 12 to 24 hours and must be fertilised in that time if a woman is to become pregnant. The. You ovulate about 12 to 14 days before the start of a new menstrual cycle. Your fertile window is the five days leading up to ovulation, plus the day of. Ovulation usually occurs between day 11 and day 21 of the cycle, counting from the first day of the last period. Ovulation usually lasts one day, can happen any. On average, a woman's cycle normally is between days, but some women may have much shorter or much longer cycles. Ovulation can be calculated by starting. Ovulation is a major event in the menstrual cycle (1). It occurs when hormones cause the release of an egg from one ovary, into your fallopian tube (2). Like. How does the menstrual cycle work? · Your cycle starts on the first day of your period and continues up to the first day of your next period. · This is 28 days on. Ovulation usually happens once each month, about two weeks before your next period. Ovulation can last from 16 to 32 hours. Ovulation does not happen if you are. Track how long it occurs. Ovulation pain can last for a few minutes up to a couple of days (1). Clue has found that the majority of people who track. These are called “dry days,” and they may be safe days if your cycle is long. Before ovulation is about to happen, your body makes more mucus as an egg starts. A step-by-step guide to conception. After ovulation the egg lives for 12 to 24 hours and must be fertilised in that time if a woman is to become pregnant. The. You ovulate about 12 to 14 days before the start of a new menstrual cycle. Your fertile window is the five days leading up to ovulation, plus the day of. Ovulation usually occurs between day 11 and day 21 of the cycle, counting from the first day of the last period. Ovulation usually lasts one day, can happen any. On average, a woman's cycle normally is between days, but some women may have much shorter or much longer cycles. Ovulation can be calculated by starting.

It uses the first date of your last menstrual period and the number of days between your periods. is a few days before and the day that you ovulate. The luteal phase begins after ovulation. It lasts about 14 days (unless fertilization occurs) and ends just before a menstrual period. In this phase, the. If pregnancy does not occur, this thickened lining is shed, accompanied by bleeding. Bleeding usually lasts for days. For most women, menstruation happens. How long is a menstrual cycle? For menstruating women, an average menstrual cycle lasts 28 days. It starts with the first day of the last period and ends with. Regular cycles that are longer or shorter than this, from 23 to 35 days, are normal. The menstrual cycle is the time from the first day of a woman's period to. Women with a day menstrual cycle typically ovulate 13 to 15 days after the start of their last period. What Happens During Ovulation? Right before. Ovulation can even occur long after your last menstrual period. Ovulation and Fertility: What You Need to Know. Signs of Ovulation. Your body does a good job. Most people ovulate between days 11 and 21 of their cycle. The first day of their last menstrual period (LMP) is day 1 of the cycle. Ovulation does not always. A step-by-step guide to conception. After ovulation the egg lives for 12 to 24 hours and must be fertilised in that time if a woman is to become pregnant. The. How do I know when I ovulate? Knowing how long your cycles are and the physical changes to watch for will help you pinpoint this. A cycle is. So, ovulation occurs only one time during each menstrual cycle and generally lasts from hours. Wow, only hours? Does that mean that's the only. How to track your cycle · If your cycle is 28 days, ovulation should occur on day Therefore aim to have regular intercourse from 10 days after your period. Ovulation typically lasts for about 24 to 48 hours. During this period, a mature egg is released from the ovary and is available for. These are called “dry days,” and they may be safe days if your cycle is long. Before ovulation is about to happen, your body makes more mucus as an egg starts. This timeframe, known as the Fertile Window, is the time to try and get pregnant! Chances of pregnancy are highest if you have sex on the day you ovulate, but. So you're probably wondering, for how many days do women ovulate? “Ovulation itself (the actual releasing of the egg from the ovary) is a relatively short event. The luteal phase begins after ovulation. It lasts about 14 days (unless fertilization occurs) and ends just before a menstrual period. In this phase, the. Getting pregnant is related to ovulation. Ovulation is the release of an egg from the ovaries. It is the time when a female who has sex is most likely to get. Enter your information. What was the date of the first day of your last menstrual period? (MM/DD/YYYY). What is the average number of days in your menstrual. It uses the first date of your last menstrual period and the number of days between your periods. is a few days before and the day that you ovulate.

How To Know How Much You Owe On Credit Card

Balance owed. Enter the amount of debt you're trying to pay off. For example, if you're paying off credit card debt, you can. Use this calculator to find out how much you owe. This can be used as a good starting point for your debt management plan. Enter all of your credit cards. When you sign in to your banking app, your accounts should be identified clearly on your home screen. Your credit card's current balance might also be listed. 1 for anyone with a credit card is to pay off that balance in full at the end of each month. But we all know that life happens, and that means that it's not. you still owe accrued interest. But there are ways to You won't need to calculate residual interest yourself—your credit card company will do that. Penalties and interest will continue to grow until you pay the full balance. Pay by debit card, credit card or digital wallet. For individuals and. When you use a credit card to make a purchase, the amount you charge is added to what you owe in total, typically referred to as your credit card's balance. Find out if you should be paying off your credit card in full each month. Learn about credit utilization rates and why it is good to pay off your balance. The statement is an overview of how much you currently owe, plus all your Everything you need to know to about credit card interest, how to avoid. Balance owed. Enter the amount of debt you're trying to pay off. For example, if you're paying off credit card debt, you can. Use this calculator to find out how much you owe. This can be used as a good starting point for your debt management plan. Enter all of your credit cards. When you sign in to your banking app, your accounts should be identified clearly on your home screen. Your credit card's current balance might also be listed. 1 for anyone with a credit card is to pay off that balance in full at the end of each month. But we all know that life happens, and that means that it's not. you still owe accrued interest. But there are ways to You won't need to calculate residual interest yourself—your credit card company will do that. Penalties and interest will continue to grow until you pay the full balance. Pay by debit card, credit card or digital wallet. For individuals and. When you use a credit card to make a purchase, the amount you charge is added to what you owe in total, typically referred to as your credit card's balance. Find out if you should be paying off your credit card in full each month. Learn about credit utilization rates and why it is good to pay off your balance. The statement is an overview of how much you currently owe, plus all your Everything you need to know to about credit card interest, how to avoid.

total amount you owe, known as your balance. minimum amount you must pay, and When you apply for a credit card, lenders check your credit history. Most credit card issuers calculate interest based on the average daily balance, not the balance at the end of the month. The earlier or more that is paid. Pay by debit card, credit card or digital wallet. For individuals and Avoid a penalty by filing and paying your tax by the due date, even if you can't pay. Calculate the credit card interest you'll owe for a given balance and interest rate. Choose your monthly payment and learn the payoff time, or enter the. Use this calculator to find out how much you owe. This can be used as a good starting point for your debt management plan. Enter all of your credit cards. How can I see my latest transactions and current balance? · Log in to AccèsD. · Under Cards, loans and credit or under Accounts in the Quick access section of the. Monthly rent or house payment · Monthly alimony or child support payments · Student, auto, and other monthly loan payments · Credit card monthly payments (use the. How to Calculate Interest Charges on Credit Cards ; Daily Periodic Rate, DPR = APR. ; ADB = (day 1 balance) + (day 2 balance) + + (day n balance). number. If the issuer determines that you owe some of the disputed amount, they must tell you promptly and in writing how much you owe and why. You may ask for. Start by getting clear on how much you've spent and what you owe on your credit cards. you figure out how soon you can pay off each credit card. Making. The most widely used method credit card issuers use to calculate the monthly interest payment is the average daily balance, or the ADB method. Since months vary. You can find your most up-to-date balance by logging in to your credit card company's portal, checking their mobile app or calling customer service. The. But if you're not careful they can be an expensive way to borrow, especially when it takes a long time to pay off what you owe if you can't pay the balance. Know Before You Owe: Credit Cards page offers important information about credit cards. Credit Card Terms and Fees. The CFPB regularly surveys the credit. It will also show your new balance, available credit (your credit limit minus the amount you owe), and the last day of the billing period (payments or charges. You can start by understanding how much you owe, how much interest you're being charged and how much you can afford to pay each month. Once you have this. For credit and debit cards the confirmation page and email is your receipt. · For payments from your bank account, the receipt only confirms you have requested. Every month you'll get a statement – this will show you your card balance, which is the total amount you owe, and give you a choice of ways to repay. Clear this. If you want to check your credit score and see how your card balances are affecting it, you can do so by using a credit monitoring service. One of our top. owe on a credit card, find out how to deal with the debt. This is the cost of borrowing on the card, if you don't pay the whole balance off each month.

When Is Apy Paid

The rate of return for certificates of deposit (CDs) is generally quoted as the APY. That's for several reasons. CDs pay compound interest either monthly or. Higher APY means your balance grows faster. How is APY different from interest? An interest rate is the amount of interest that is paid on an investment or a. APY, meaning Annual Percentage Yield, is the rate of interest earned on a savings or investment account in one year, and it includes compound interest. The annual percentage yield measures the total amount of interest paid on an account based on the interest rate and the frequency of compounding. Interest is compounded and credited to the account on a monthly basis. The APY assumes interest remains on deposit until maturity. If account is closed before. Earn up to % APY on all balances with a Secure Money Market account or UFB Secure account! See site for details. APY is the total interest you earn on money in an account over one year, whereas interest rate is simply the percentage of interest you'd earn on a savings. The savings dividend provides an Annual Percentage Yield (APY) of %. The APY is accurate as of the 8/6/ dividend declaration date. Dividends are paid. APY stands for Annual Percentage Yield, the percentage return on your money. It's an excellent way to compare different banks' accounts because it accounts for. The rate of return for certificates of deposit (CDs) is generally quoted as the APY. That's for several reasons. CDs pay compound interest either monthly or. Higher APY means your balance grows faster. How is APY different from interest? An interest rate is the amount of interest that is paid on an investment or a. APY, meaning Annual Percentage Yield, is the rate of interest earned on a savings or investment account in one year, and it includes compound interest. The annual percentage yield measures the total amount of interest paid on an account based on the interest rate and the frequency of compounding. Interest is compounded and credited to the account on a monthly basis. The APY assumes interest remains on deposit until maturity. If account is closed before. Earn up to % APY on all balances with a Secure Money Market account or UFB Secure account! See site for details. APY is the total interest you earn on money in an account over one year, whereas interest rate is simply the percentage of interest you'd earn on a savings. The savings dividend provides an Annual Percentage Yield (APY) of %. The APY is accurate as of the 8/6/ dividend declaration date. Dividends are paid. APY stands for Annual Percentage Yield, the percentage return on your money. It's an excellent way to compare different banks' accounts because it accounts for.

APR stands for annual percentage rate. The term refers to the interest you pay for borrowed money, including any additional fees. Annual percentage yield (APY) is a normalized representation of an interest rate, based on a compounding period of one year. APY figures allow a reasonable. APY stands for Annual Percentage Yield. It is basically a fancy name for the rate of return you get on your money after accounting for compounded interest. APY = Annual Percentage Yield↵ · Rate and Annual Percentage Yield (APY) paid provided the qualifications are met; otherwise you do not earn dividends that month. APY reflects the amount you actually stand to earn in a year on an account that pays interest. With each period going forward, the account balance gets bigger. Interest Rates are subject to change without notice. Interest is compounded daily and paid monthly. Interest is calculated and accrued daily based on the daily. The interest rate is the annualized rate paid on the account, such as %. APY factors in the effect of compounding interest over a year. So while the nominal. APY stands for annual percentage yield and refers to the amount of interest generated by your money if it is kept in an account for a year. Learn more. Calculate the Annual Percentage Yield (APY) or effective annual rate for an investment based on an annual interest rate and compounding frequency. With most savings accounts and money market accounts, you'll earn interest every day, but interest is typically paid to the account monthly.4 However, CDs. How much does a savings account pay in interest on average? The Raisin name and logo are trademarks of Raisin GmbH. All other trademarks, logos, marks, and. The rate of return for certificates of deposit (CDs) is generally quoted as the APY. That's for several reasons. CDs pay compound interest either monthly or. A savings account's annual percentage yield, or APY, determines the amount of interest an account holder earns in a year. This is an important number to look at. APY is expressed as a percentage based on the compound interest you earn on the dollar amount in your account. This amount is calculated daily and added to your. The APY represents the amount of interest you'll earn in a year when compounding is factored in. This effect leads to greater returns, especially over longer. APR tells you how much interest you'll pay for money you borrow and includes fees. APY tells you how much interest you can earn on savings and includes. paying for a vacation or Suppose you have $1, in an HYSA that is earning 4% annual percentage yield (APY) interest rate that compounds annually. For example, if the last day of the month is a Sunday, that month's interest will be paid on the preceding Friday, along with what you would earn on Saturday. Key takeaways · APY is the annual percentage yield for a savings account, including compound interest. · APY often refers to interest earned on savings accounts. All banks invest your savings in certain ventures and in return, you are paid interest. Interest rates fluctuate depending on the actions of the Federal Reserve.